What is a salary structure?

A salary structure is a framework that defines how an organisation compensates its employees. It serves as the blueprint for distributing salaries and ensures fair, transparent, and consistent remuneration across different levels within the organisation. It provides clarity on how much an individual earns and how the amount is broken down into different components like basic salary, gross salary, net salary, and deductions.

An effective salary structure will help keep the organisation at the edge of the highly competitive market and in turn motivate employees and plan their compensation budgets effectively. A clear salary structure equates also to increased employee satisfaction and lesser disputes over pay. Salary structures allow employers to standardise pay scales in order to address promotions easily, bonuses, and raises.

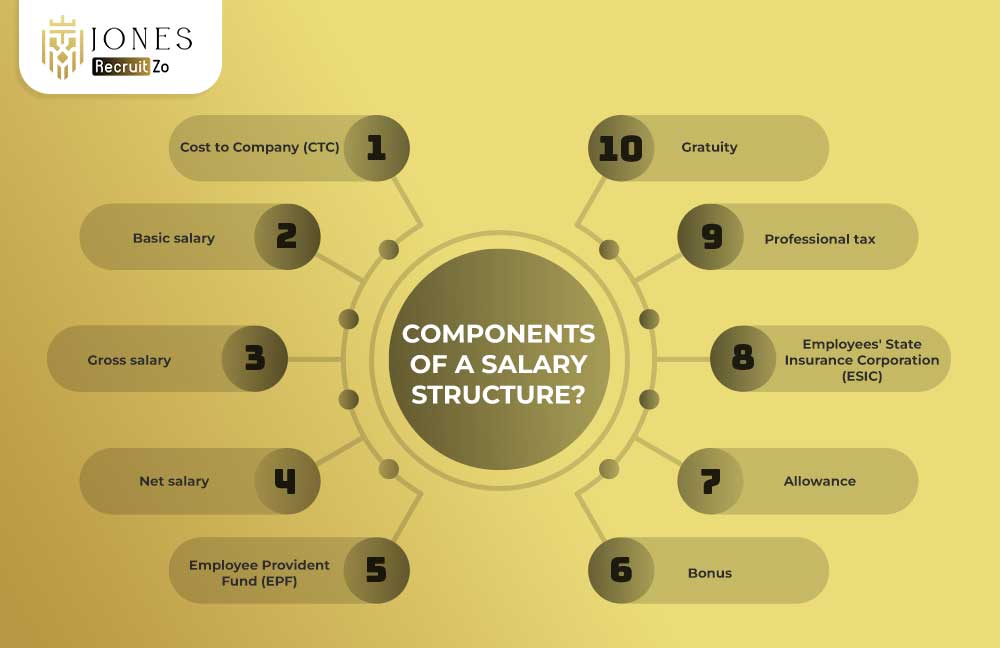

What Are The Components Of A Salary Structure?

A salary structure is composed of multiple elements, each playing a significant role in determining the final payout. Let’s explore each component in detail.

-

Cost to Company (CTC)

The CTC is the total amount a company spends on an employee annually. CTC sums all fixed and variable components into a salary structure-his component of his compensation package, e.g., basic pay, allowances, bonuses,and employer contributions in EPF or insurance. Thus knowing the difference between CTC and take-home salary is very important for an employee, as with CTC, the real cost to the company is gross and not what they get immediately.

-

Basic salary

The basic salary is the fixed portion of an employee’s compensation and forms the foundation of the salary structure. It is an important part of the gross salary and is used to calculate other components of the salary like bonuses, allowances, etc. A higher amount in basic salaries could lead to higher contributions towards EPF and taxes, thus affecting the net salary received.

-

Gross Salary

The gross salary is the total amount that the employee earns without deductions. This comprises basics, allowances, bonuses, and incentives, which, however, exclude the company’s contribution, such as provident funds or insurance. Gross salary enables employees to assess their total earning potential before deductions by the compulsion of laws.

-

Net salary

Net or take-home salary is the final amount left after deductions such as taxes and provident fund contributions have been removed from one’s gross salary. This is what employees budget for their daily spending, which is usually lower than gross salary because of the mandatory deductions.

-

Employee Provident Fund (EPF)

It is a mandatory deduction in which a part of the basic salary is contributed by both the employer and the employee. Hence, it is a provision for employees with saving for their retirement, an integral part of their pay structure. The EPF fund benefits not only grow with time for convenience at post-retirement; it even has advantages attached, like partial withdrawals.

-

Bonus

It is an extra amount of payment given to the employees along with the salary structure. This can be a performance or annual bonus. It enhances employee motivation and productivity. At times, bonuses are offered as incentives for improving performance and creating a sense of achievement among employees.

-

Allowance

Allowances are only the extra payments for a specific need, such as housing, travel, medical, etc. The most common are the House Rent Allowance (HRA), Transportation Allowance, and Dearness Allowance. Beyond certain limits, allowances are taxable, but they compensate and give relief to employees without incurring some essential costs.

-

Employees’ State Insurance Corporation (ESIC)

Contributions made under ESIC are often used for providing employees under certain prescribed limit salaries having both medical and financial benefits.Under this same ESIC, employers and employees offer a small portion of their salaries to the ESIC fund. Hence, ESIC provides the benefits to employees and their dependents for using medical facilities and getting other financial benefits in case of medical emergencies.

-

Professional tax

This is a state-driven deduction that is from the salary paid to the employees, and it varies from state to state in its deductions every month from the employees’ salary structure. This amount is really small but is one of the compliance requirements of an organisation to avoid penalties.

-

Gratuity

This is a monetary benefit given to employees who have served the organisation for a period of five years or more. Gratuity is calculated as a multiple of an employee’s basic salary and the service period in years. It is a way of thanking the employee for his long service to the company as a one-time benefit upon leaving employment.

What Are The Types Of Salary Structures?

Different organisations adopt varying types of salary structures to meet their goals. Below are the most common types.

-

Traditional structure

The traditional salary structure is hierarchical, where pay is based on job titles and experience. It typically includes fixed increments over time. It works well for organisations with clear chains of command and defined levels of responsibility.

-

Step structure

The step structure involves predefined pay increments at regular intervals. Employees progress through salary steps as they gain experience or meet performance standards. This system is often used in government and public-sector organisations to ensure transparency.

-

Graded structure

The graded structure judges jobs into salary grades per the efficacy of skills, responsibilities, and experience in minimum to maximum salary ranges in order to manage salaries through common pay bands.

-

Broadband structure

A more generalised class of job roles grouped under a single “band,” thus offering flexibility in pay. This would be intended for managing those roles that require different skills and used by those who stress performance-based pay to create problems for their competitors in terms of base pay.

-

Market-based structure

The market-based structure determines salaries based on market data and industry benchmarks, ensuring competitiveness in attracting talent. This structure is particularly beneficial for organisations operating in industries with rapidly changing salary trends.

-

Skill-based structure

Instead of giving a salary in accordance with a particular job title as per the employee, the construct is meant purely for the skill reflected through the employee. The accrual of an employee in acquiring a new skill or certification forms the basis for reward. It does thus encourage overall development in the profession, motivating the employee to upgrade his skills with the current times.

-

Flat structure

Such a flat structure in salaries implies equal salaries for similar roles, thereby achieving the desired equality and reduced difference across salaries. Mostly, startup companies and small businesses are small on flat salary structure models meant for simplicity and transparency.

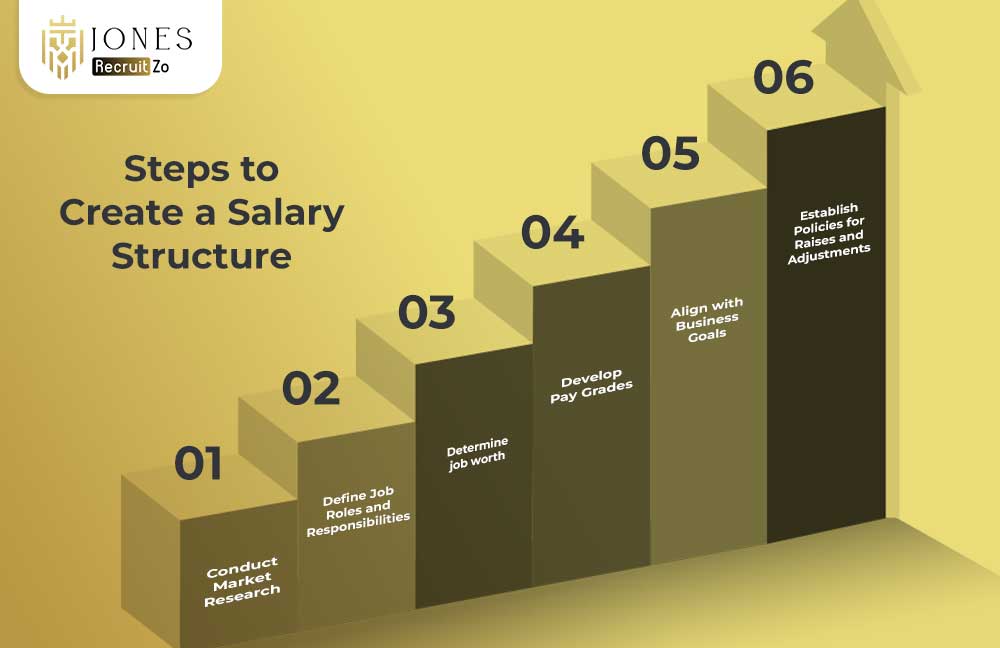

Steps to Create a Salary Structure

Creating a salary structure involves a strategic approach to ensure fairness, competitiveness, and alignment with business goals.

-

Conduct Market Research

The first step would be an in-depth market research process to examine the industry standards, competitor salaries, and regional pay trends. This adds up to ensure that the salary structure remains competitive. Market research helps an organisation understand where the pay gap prevails and thus develop a realistic compensation plan.

-

Define Job Roles and Responsibilities

Clearly outline job roles, responsibilities, and expectations. This helps determine appropriate compensation levels within the variability of the salary structure. Detailed job descriptions eliminate ambiguity and enable accurate salary benchmarking.

-

Determine job worth

The worth of each job should be assessed by taking into consideration its worth for the organisation, the skills required, and the market demand. This secures the same fair and equal remuneration for every role, and critical positions are prioritised based on the job worth analyses.

-

Develop Pay Grades

Create pay grades that group similar roles into salary ranges. Pay grades help maintain consistency and clarity in the salary structure. Establishing clear pay grades simplifies compensation decisions for promotions and lateral movements.

-

Align with Business Goals

Ensure that the salary structure aligns with your company’s financial goals and growth strategy. Balancing employee satisfaction with business sustainability is essential. A well-aligned structure boosts productivity and helps retain top talent.

-

Establish Policies for Raises and Adjustments

Define clear policies for salary increments, promotions, and adjustments. Transparent policies ensure fairness and help in retaining talent within the organisation. Having defined policies also reduces bias and ensures consistency in rewarding performance.

FAQs

1) What is a salary structure?

A salary structure is a systematic framework that outlines how employees are compensated in an organisation. It breaks down the total salary into different components, such as basic salary, allowances, bonuses, and deductions. A well-defined salary structure ensures fair, consistent, and transparent pay across job roles, helping businesses align compensation with responsibilities and performance.

2) What are the different types of salary structure?

The common types of salary structures include the traditional structure, step structure, graded structure, broadband structure, market-based structure, skill-based structure, and flat structure. Each type serves specific organisational needs, from fixed pay increments to flexible and market-driven compensation. Businesses adopt the most suitable structure based on their industry, goals, and workforce.

3) Why is salary structure important?

A salary structure is important as it ensures fair and equitable pay, motivates employees, and maintains internal consistency. It helps organisations attract and retain talent while aligning compensation with industry standards and business objectives. A clear salary structure also reduces disputes, promotes transparency, and enhances employee satisfaction.

4) How to make the salary structure?

To make a salary structure, start by conducting market research to analyse industry benchmarks. Define job roles and responsibilities, determine the worth of each job, and group roles into pay grades. Align the structure with the company’s financial goals and establish clear policies for raises and adjustments. This ensures fairness, competitiveness, and long-term sustainability.