What Is Payroll Processing?

The payroll function includes calculation and processing of employee compensation, such as salaries and allowances, as well as deductions and liabilities for all employees. More importantly, the payroll process primarily ensures that an employee receives his or her salary accurately and on time while observing local and national regulations. Payroll processing has a very significant place among the factors that play a vital role in employee satisfaction and the efficiency of the organisation. Payroll processing refers to the administrative function of processing the remuneration of employees.

It entails calculating wages and all other deductions, such as tax or benefit deductions, and observing specific conditions being met because of labour laws. This process benefits human resource management in tracking the timeliness and correctness of salary disbursal to the various workers, which directly impacts their satisfaction and trust towards the organisation.

Payroll processing also entails statutory compliance regarding PF contributions, ESI, and TDS, among others, which is very specific now to Indian businesses. Not only are smooth operations aided by streamlined payroll methods, but penalties can also be avoided.

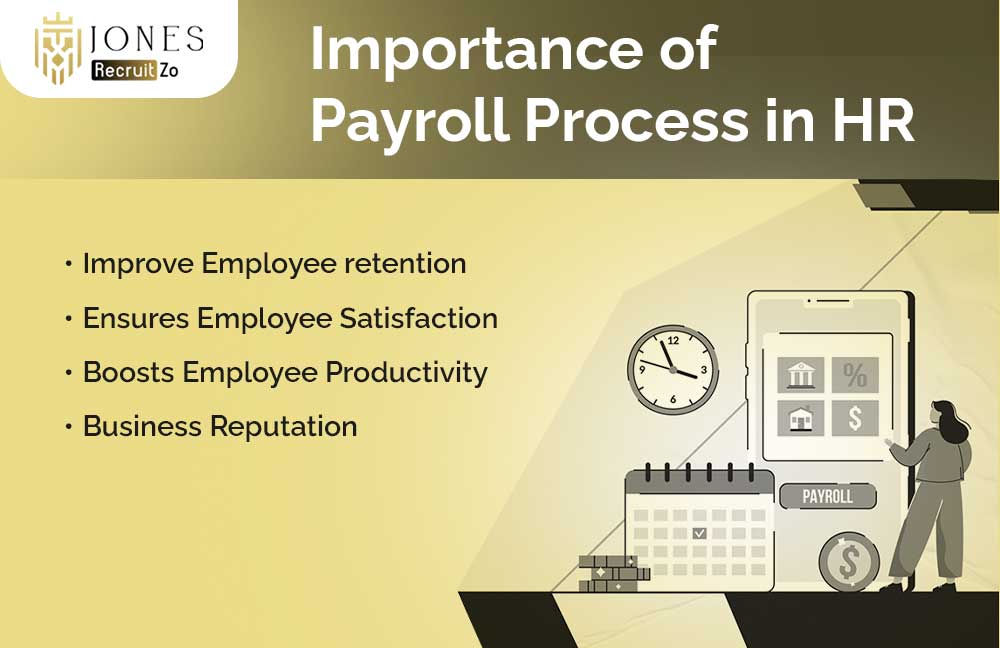

Importance of payroll process in HR

Payroll processing integrates more than the mere act of paying an employee. This human resource component plays an indispensable role in the overall performance of the organisation.

-

Improve Employee Retention

A payroll system has the capability to determine the best level of accuracy of payment and, as such, improve the timeliness of payment. As such, it enhances trust and motivation by the employee. The employee must ever be convinced that he/she has been fairly rewarded so that he/she will remain in the organisation. In competitive markets such as India, infusing talent has become a great challenge, and effective payroll systems can help a lot.

-

Ensures Employee Satisfaction

Employees would like clarity and accuracy regarding their salaries. An efficient payroll system should be put in place such that it supports timely disbursements, appropriate documentation, and transparency on deductions. Employees usually enjoy a better feeling about their pay and, as a result, higher Employee satisfaction and morale that would benefit the entire organisation.

-

Boosts Employee Productivity

When payroll is effectively processed, it frees up workers to focus on work without having to think about differences or delays in payment. Payroll processing is an avenue for employee engagement and motivation, which directly leads to increased productivity.

-

Business Reputation

How well a company manages its payroll is reflective of the professionalism and reliability of such a company. An organisation will build a positive image when it pays its employees on time and abides by compliance requirements. Not only will such practices win over highly skilled professionals from the company to work in, but they will also help in making a good reputation with clients, stakeholders, and regulatory agencies.

Steps to Processing Payroll

A streamlined and systematic payroll processing system comprises key steps that ensure accuracy and compliance.

-

Employee Onboarding

The new employees are inducted into the work and are introduced to the company’s payroll system that captures their personal, banking, and tax information. This allows for current data to be produced by the organisation to pay and comply with all criteria that form the basis of error-free payroll processing.

-

Define Payroll Policy

A payroll policy transmits clearly the rules around employee compensation. It states the salary structure, bonuses, overtime pay, and deductions. Policies should be formulated in line with the labour laws and also should be fully communicated to employees. This minimises the confusion and sets up expectations for payroll processing.

-

Track Attendance and Leaves

Attendance and leaves will appear in the payroll accounting because it is the basis of pay calculation. Many attendance management systems or biometric systems are now used in most companies to record working time and leave balances. The attendance records must be integrated into the payroll system for fair compensation.

-

Calculate Gross Pay

Gross pay stands for the entire remuneration before deductions for an employee, which includes base salary, overtime, and bonuses, among other things. This calculation must be very accurate and take into account various elements such as other allowances and benefits. It also helps the payroll to be very transparent in convincing and accurate payroll processing, as it helps understand better how gross pay works.

-

Apply Deductions

Deductions, such as taxes, PF, ESI, or loan repayments, are subtracted from the gross pay to determine the net salary. Organisations must stay updated on statutory compliance requirements to avoid legal penalties. Accurate deductions ensure both the organisation and employees meet their financial obligations.

-

Disburse salaries and issue payslips

Once the net pay calculation is over, then it will be transferred to the employee’s bank account. Payslips are generated shortly after that, which include gross pay, deductions, and net salary. This transparency forms the trust and keeps employees well-informed on their earnings against all deductions.

-

Compliance and reporting

The final stage is compliance reporting and includes the filing of income tax returns and contributions towards social security schemes. In India, an organisation has to comply with some regulations such as those of TDS, PF, and ESI. This, along with maintaining regular audits and reporting, keeps the organisations compliant and out of legal risks.

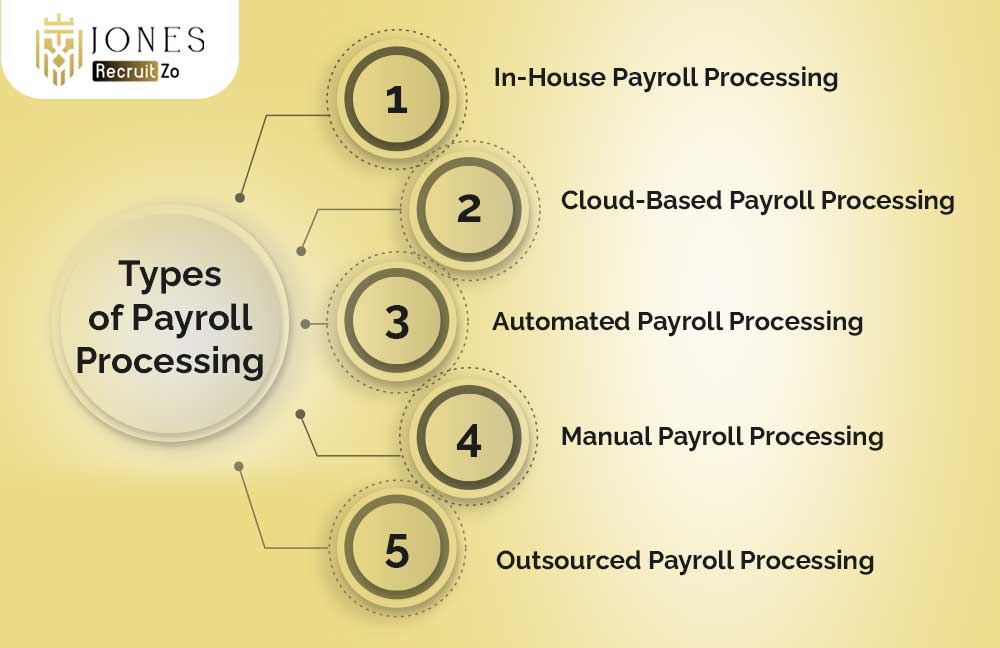

Types of Payroll Processing

Organisations can now select among a variety of ways of processing their payroll based on their size, budget, and needs.

-

In-House Payroll Processing

In-house payroll processing is the management of payroll internally, usually with the help of HR teams and software. This gives organisations control but takes time, resources, and expertise. This payroll processing methodology best suits companies with a small workforce or easy payroll processing.

-

Cloud-Based Payroll Processing

With cloud-based systems gaining prominence in Asia, especially in India, on account of their convenience and scalability, these platforms automate payroll calculation, compliance, and reporting and are so accessible from almost anywhere. They are usually ideal for businesses that want cheaper and more efficient apps.

-

Automated Payroll Processing

Automated payroll processing uses the latest software to conduct all payroll activities, from calculations to compliance requirements. Error reduction time savings and improved accuracies primarily benefit businesses with a high volume of staff and complicated payroll structures.

-

Manual Payroll Processing

This is processing payroll using a spreadsheet or another manual way of calculating wages and deductions. This is good for the smallest businesses, but it’s usually filled with errors and takes a lot of time. As businesses grow, they will typically follow the processes into an efficient method, such as a computerised or cloud-based system.

-

Outsourced Payroll Processing

Having outsourced payroll processing is hiring third-party specialists to handle payroll tasks for your company. It would save time and ensure compliance while letting the HR department concentrate on other core business activities. This is a treatment most preferred by medium and large organisations in India seeking professional payroll expertise.

Challenges in Handling the Payroll Process

Managing payroll can be challenging, especially for organisations operating in complex environments.

-

Keeping Up with Compliance

Payroll processes have, essentially, the most challenging parts due to complications in processing due to tax laws and labour laws. For instance, in India, legal acts like PF, ESI, and TDS keep evolving. Failure in following them is just as good as attracting a penalty, and hence, it is a must to remain in touch with the legal requirement.

-

Data Security

Sensitive employee information regarding the bank nominee and personal identifiers is hence found in the payroll data. So, if one needs to protect this data, he should protect it from breaches, which, in turn, retains the employee’s confidence and liability. The highly secure payroll systems and protocols will act as safeguards for information.

-

Spreadsheet Complications

Most payroll processing activities will rely on spreadsheets, which raise the chances of errors being made-or be actual “system” errors-and cause data to get lost in translation, leading to very possible salary disputes or compliance issues. A shift to an automatic system reduces both scenarios while improving efficiency as well.

-

Handling Multi-State Operations

For organisations with employees across multiple states in India, managing varying tax laws and labour regulations can be challenging. Each state has its own requirements, making it essential to have a robust payroll system that accommodates diverse compliance needs.

FAQs

1) What is payroll processing?

Payroll processing is the management of the remuneration of the employees, which includes all calculations of salaries, deductions, and bonuses. Payroll ensures timely and accurate payments to employees in conformity with the provisions of labour laws and tax regulations. This, of course, is an important HR function, which further contains generating payslips and rendering reports to regulatory authorities.

2) What is payroll processing in HR?

Payroll processing in HR refers to the processes of employees’ salaries and benefits as part of the entire human resource operations of an organisation. HR undertakes the payroll policy, attendance, compliance with labour laws, and the entire flow of payroll for fair and timely compensation of employees.

3) 5 Basic Steps in Processing Payroll?

The five basic steps in processing payroll include:

Defining Payroll Policy

Tracking Attendance and Leaves

Calculating Gross Pay and Deductions

Salary Disbursement and Compliance

4) How to calculate payroll?

To calculate payroll, start by determining the employee’s gross pay based on their salary or hourly wage. Add bonuses and allowances, then subtract deductions like taxes, Provident Fund (PF), and Employee State Insurance (ESI). The resulting amount is the net pay, which is transferred to the employee’s bank account. Automated payroll systems can simplify this process and reduce errors.